Credit Analysis & Research (CARE) reaffirmed 'BB-' ratings to Hind Industries' long -term bank facilities of Rs 360.4 million. CARE reaffirmed 'A4' ratings to the company's short-term bank facilities of Rs 465 million.

CARE reaffirmed 'BB-/ A4' ratings to the company's long/ short-term bank facilities of Rs 22.5 million.

CARE reaffirmed 'BB-/ A4' ratings to the company's long/ short-term bank facilities of Rs 22.5 million.

The ratings continue to be constrained by HIL's moderate financial profile marked by a leveraged capital structure and stretched coverage indicators, working capital intensive nature of operations due to long operating cycle and high exposure to group companies.

Furthermore, the rating also takes into account the regulatory risks and susceptibility of margins to the volatility in the foreign exchange rates. The ratings, however, draw comfort from the experienced promoters, long track record, diversified geographical operations and established brand name in the meat processing industry.

Going forward, the ability of HIL to improve the profitability margins along with effective working capital management would be the key rating sensitivities.

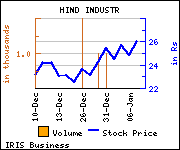

Shares of the company gained Rs 1.2, or 4.83%, to settle at Rs 26.05. The total volume of shares traded was 100 at the BSE (Tuesday).